Not sure what the Corporate Transparency Act (CTA) is or how it impacts HOAs? First, check out our article, Understanding the Corporate Transparency Act for HOAs, to learn the basics of the CTA.

Once familiar with the CTA, this guide will walk you through filing a Beneficial Ownership Information (BOI) Report for your HOA. We'll also provide a free preparation worksheet to help you organize the necessary information and ensure a smooth filing process.

March 2, 2025: Treasury Department Announces Suspension of Enforcement of Corporate Transparency Act Against U.S. Citizens and Domestic Reporting Companies.[9]

The U.S. Treasury Department issued a statement that, with respect to the Corporate Transparency Act, they will not enforce any penalties or fines associated with the beneficial ownership information reporting rule under the existing regulatory deadlines, and will further not enforce any penalties or fines against U.S. citizens or domestic reporting companies.

December 28, 2024: FinCEN has extended the deadline and is accepting voluntary submission.[8]

Due to ongoing litigation, the deadline for filing has been extended to January 13, 2025. The latest update from the FinCEN website states:

"In light of a recent federal court order, reporting companies are not currently required to file beneficial ownership information with FinCEN and are not subject to liability if they fail to do so while the order remains in force. However, reporting companies may continue to voluntarily submit beneficial ownership information reports."

December 5, 2024: A federal judge in Texas has blocked enforcement of the Corporate Transparency Act nationwide.[7]

On December 3, 2024, U.S. District Judge of the Eastern District of Texas issued a preliminary ruling that temporarily blocks the CTA and FinCEN's rule requiring companies to report their BOI. The ruling means:

1. The CTA and the rule requiring BOI reporting is paused.

2. The January 1, 2025, deadline for reporting is paused.

3. Companies do not need to comply with the BOI reporting deadline until the court decides further.

Earlier Legal Challenges: Several courts considered motions challenging the CTA, but the reporting requirements for most HOASds remain effect pending the resolution of these cases.[1][2][3][5][6]

How to File a Beneficial Owner Information Report (BOIR)

Filing a BOIR requires specific details about each beneficial owner. Here's what needs to be included:

BOI Report Requirements

To file a BOIR, you'll need to provide specific details about your HOA and its beneficial owners. Here's what you'll need:

- The HOA information

- Information for each beneficial owner including:

- The full legal name

- Residential address (not a business address)

- Date of birth

- Unique identifying number from an acceptable identification document (e.g., driver's license, passport)

- Image of the identification document (e.g., a clear photo of the driver's license or passport)

Steps to Electronically File a BOIR

- Gather the Required Information. Use the worksheet provided below.

- Visit FinCEN's BOI E-filing Website. Then click "File BOIR" or "Get Started" with E-Filing.

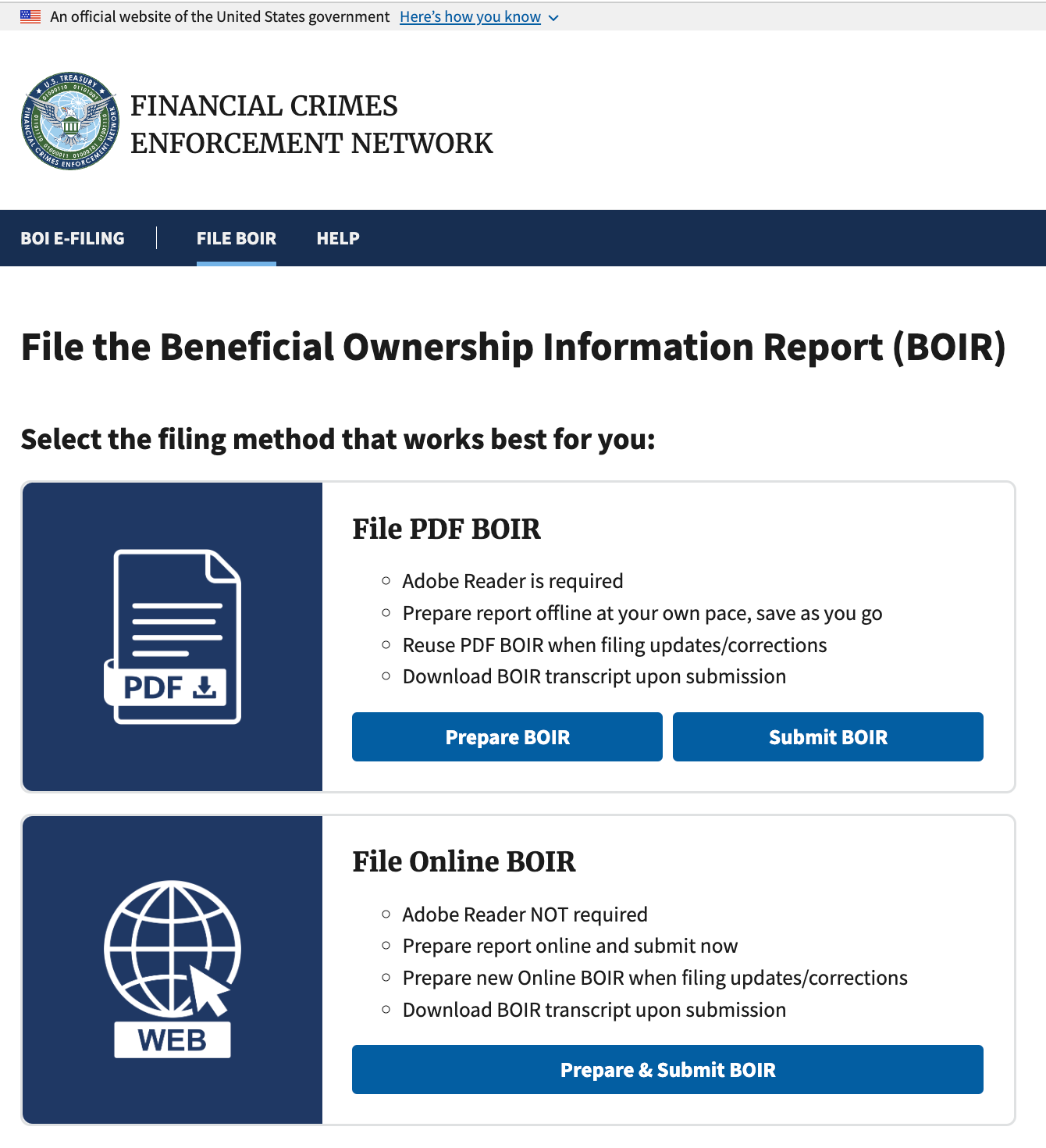

- Click Prepare & Submit BOI to e-file.

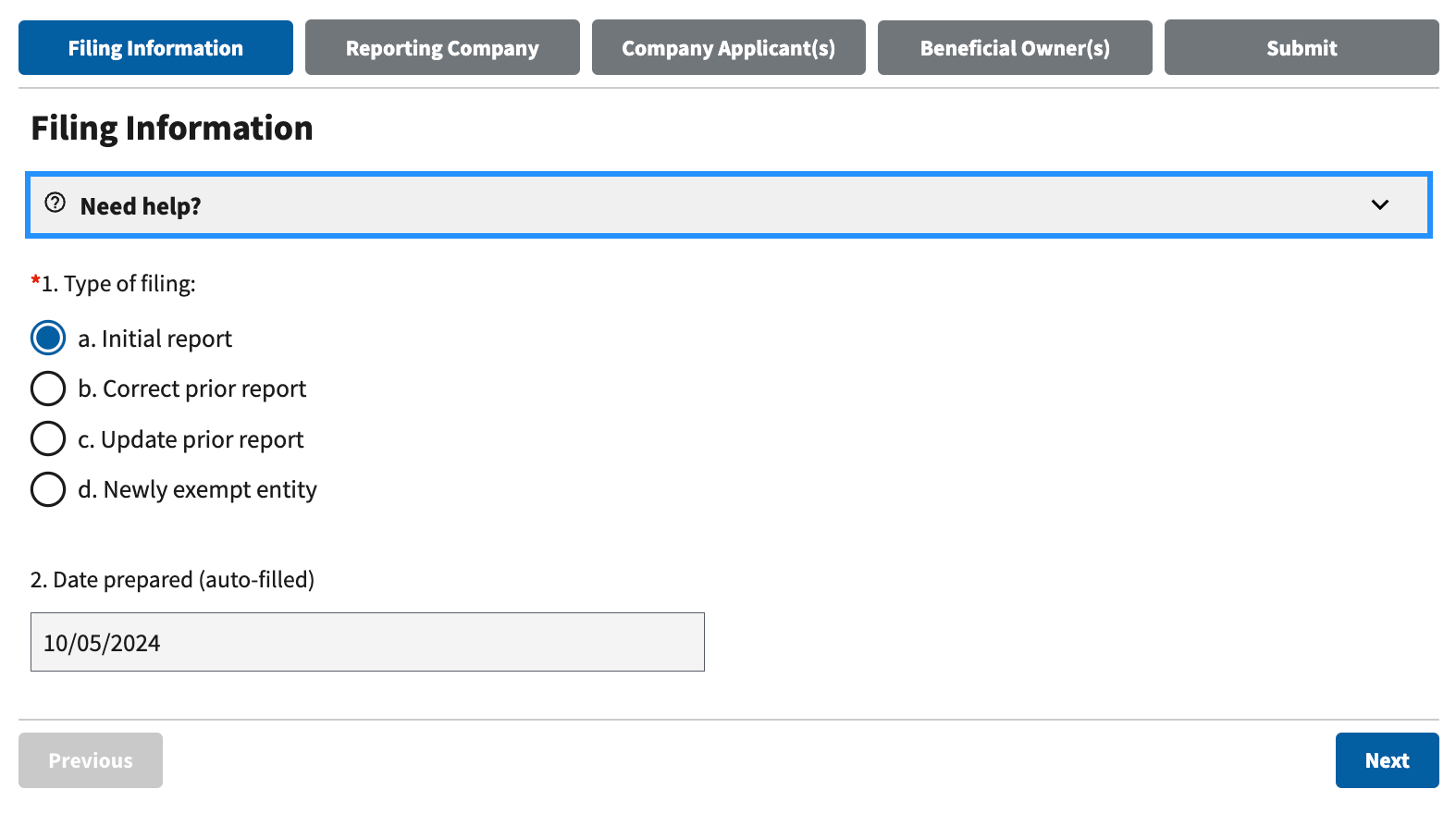

Filing Information

- Select Type of filing.

- Initial report if this is the first BOIR filed for the reporting company.

- Correct prior report if the report corrects inaccurate information from a previously filed BOIR.

- Update prior report if the report updates a previously filed BOIR, for example, to add one or more new beneficial owners.

- Newly exempt entity if after having filed a BOIR, the reporting company is now exempt from BOI reporting requirements.

- Date prepared is auto-filled.

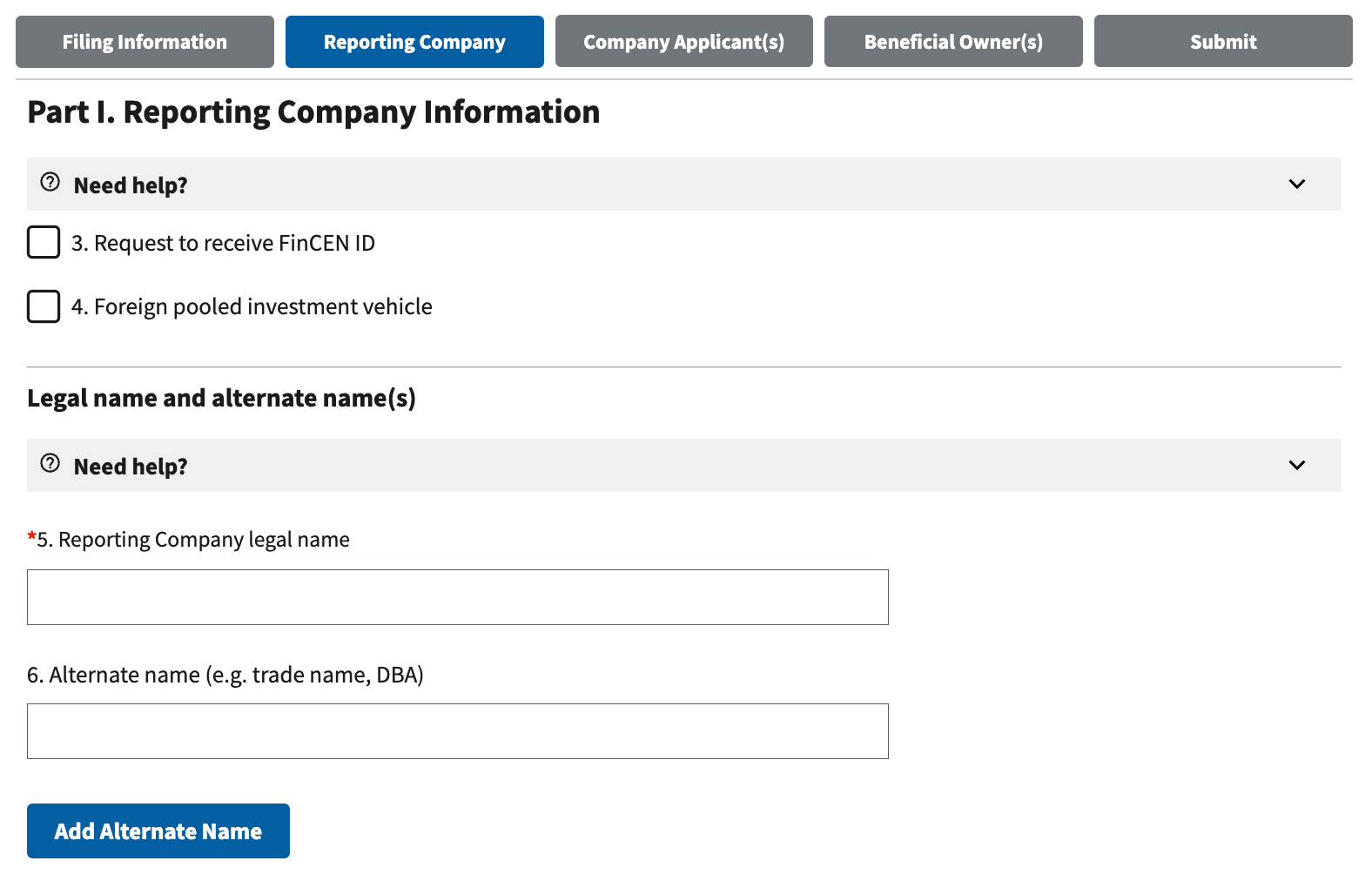

Part I. Reporting Company Information

- Select Request to receive FinCEN ID if you would like a unique identifier. A FinCEN ID is not a requirement for BOI reporting[4].

- Select Foreign pooled investment vehicle if you're an overseas investment fund where multiple investors' money is combined to invest in the various assets. [5].

- Enter your official HOA name as the Reporting Company legal name. You can find this in your Articles of Incorporation or by looking it up from the Secretary of State registration. Refer to our detailed guide on How to Verify Your Homeowners Association's Corporate Status: A State-by-State Guide for California, Florida, and Texas.

- Enter your HOA's Alternate name, if applicable.

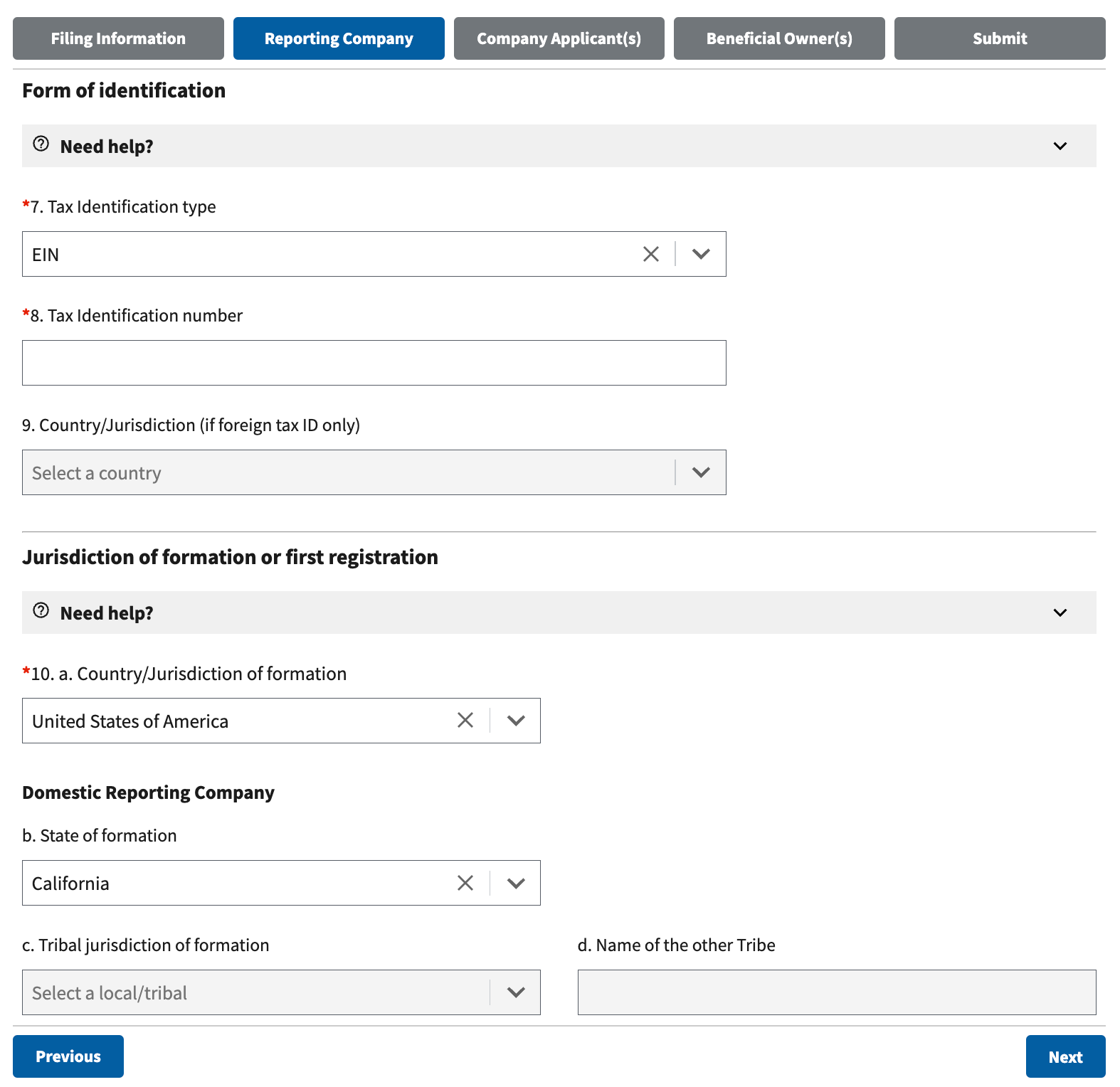

Reporting Company: Form of Identification

- Enter your HOA's Tax Identification Type, typically EIN which can be found on your tax filing.

- Enter your Tax Identification number.

- Unless you select "Foreign" in Step 7, you won't be required to select a country

- For Jurisdiction of formation or first registration:

- Select Country

- State of formation

- Tribal jurisdiction of formation

- Name of the other Tribe

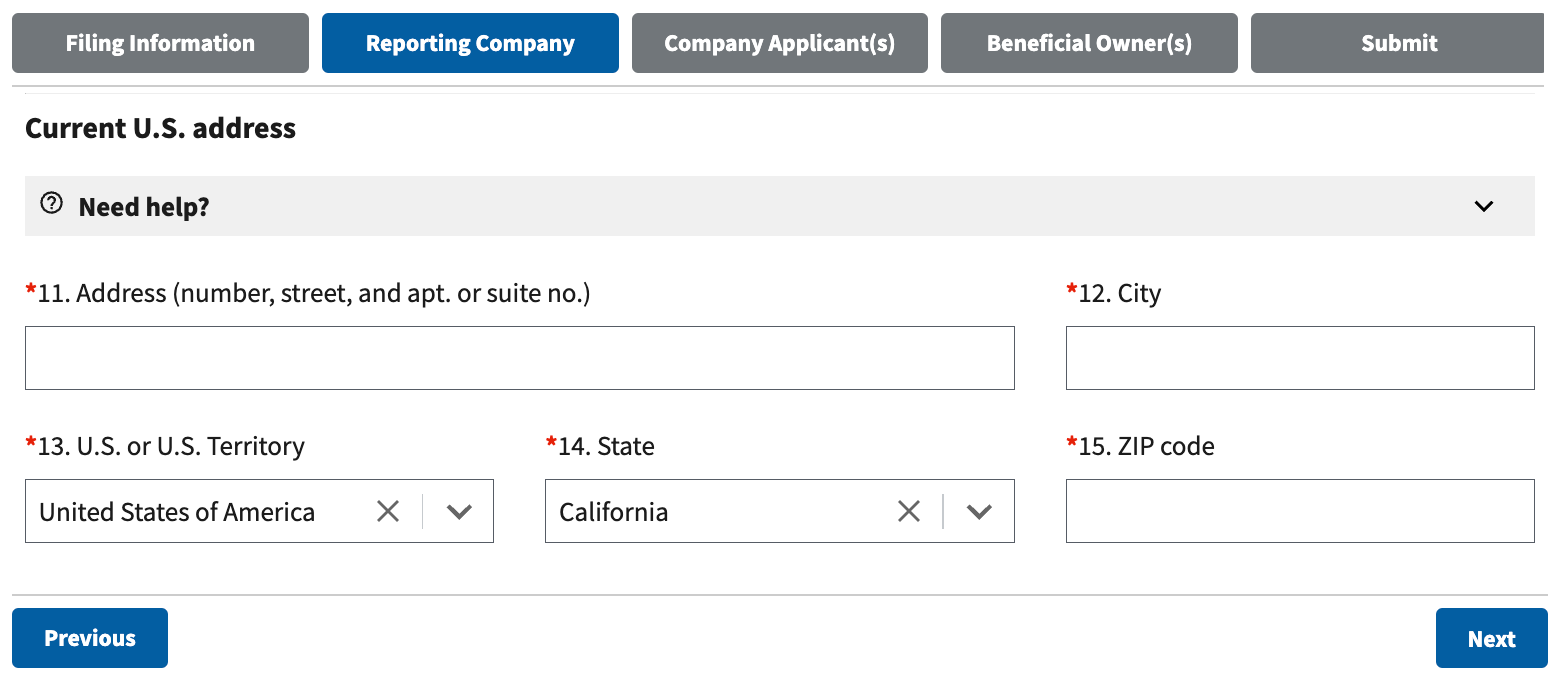

Reporting Company: Current U.S. Address

- Enter your HOA's address.

- Enter your HOA's City.

- Select your HOA's Country

- Select your HOA's State.

- Enter your HOA's ZIP code.

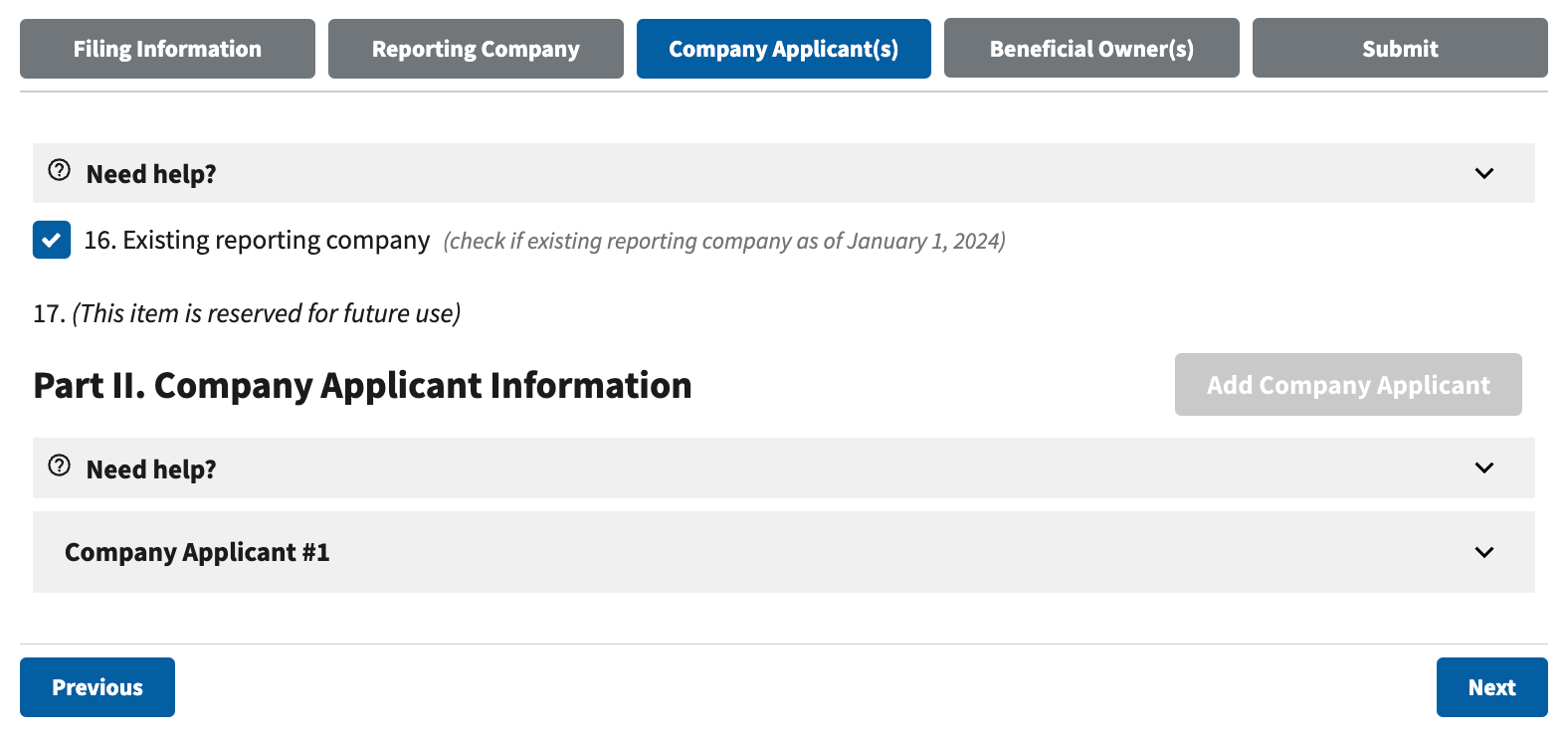

Part II. Company Applicant Information

- Check Existing reporting company if the reporting company was created or registered before January 1, 2024.

- (This item is reserved for future use)

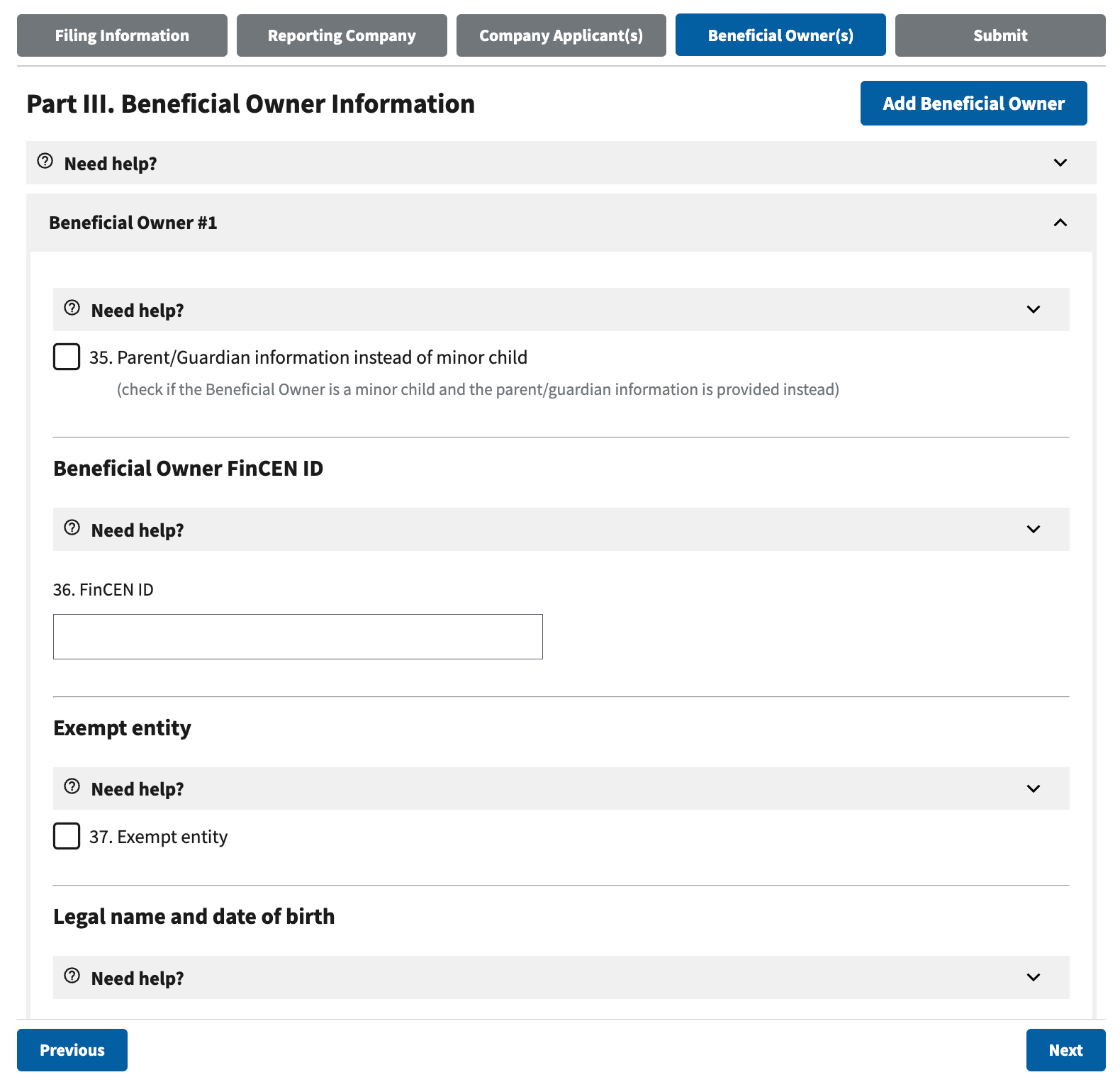

Part III. Beneficial Owner Information

For each Beneficial Owner:

- Check Parent/Guardian information instead of minor child if Beneficial Owner is a minor child and the parent/guardian information is provided instead

- Enter FinCEN ID if you have one.

- Check Exempt entity if the beneficial owner holds its ownership interest in the reporting company exclusively through 1 or more exempt entities and the name of that exempt entity or entities are being reported in lieu of the beneficial owner's information.

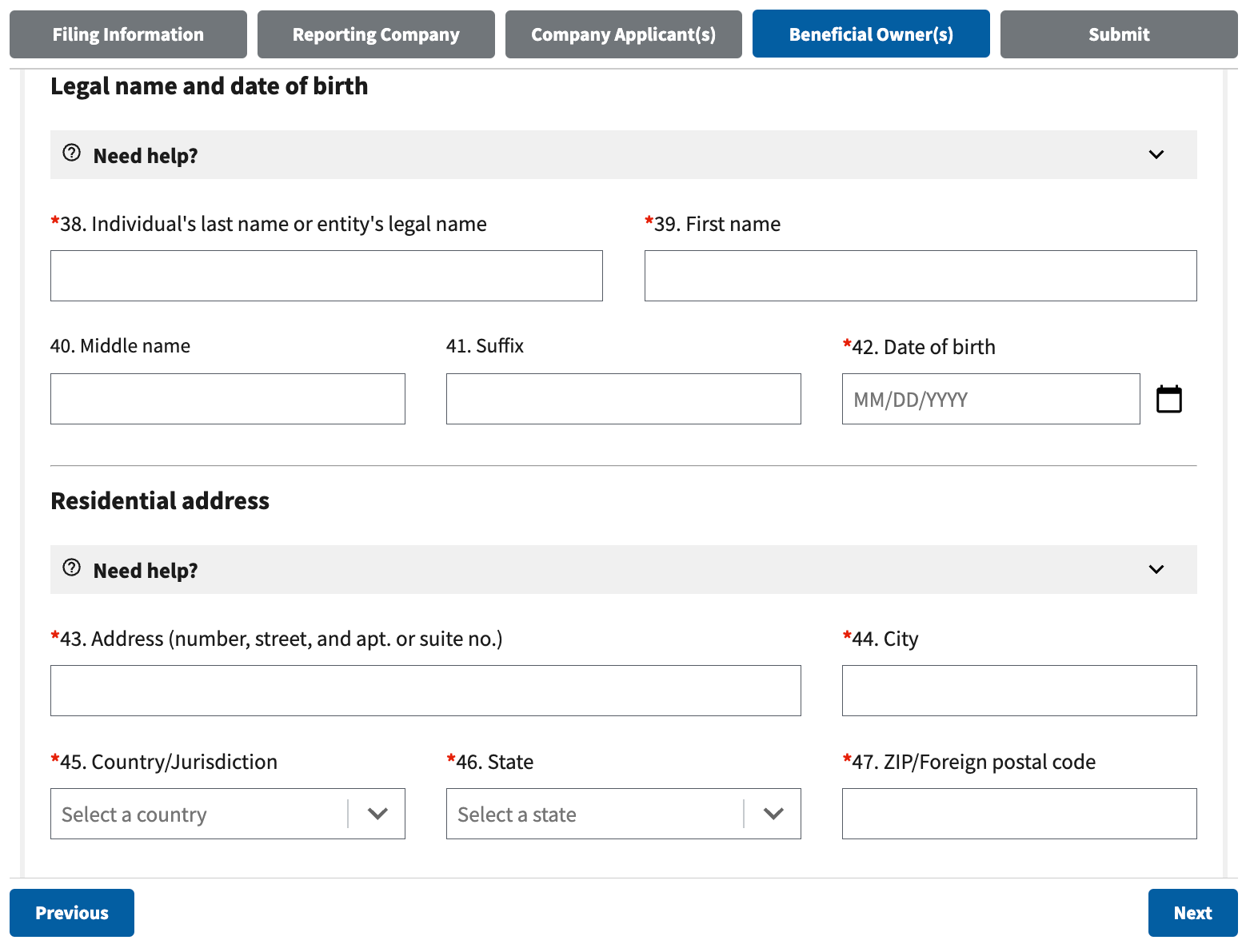

For the Beneficial Owner:

- Enter the Individual's legal last name or entity's legal name.

- Enter the legal First name.

- Enter the legal Middle name if applicable.

- Enter the legal Suffix if applicable.

- Enter the Date of birth.

- Enter the residential Address.

- Enter the residential City.

- Select the residential Country/Jurisdiction.

- Select the residential State.

- Enter the residential ZIP/Foreign postal code.

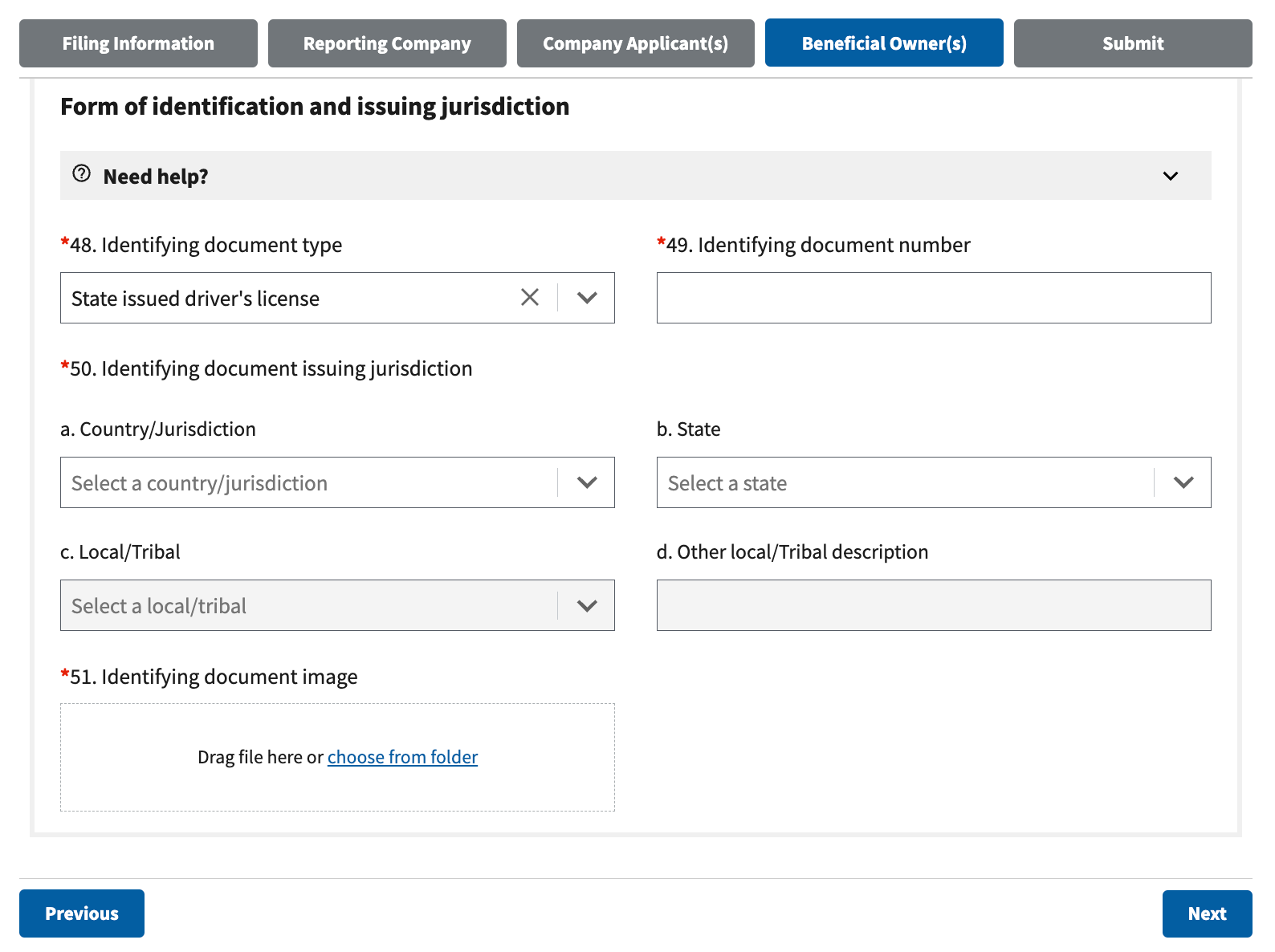

For the Beneficial Owner:

- For the Identifying document issuing jurisdiction:

- Select a Country

- Select a State

- Select a Local/Tribal

- Enter Other local/Tribal description

- Upload the Identifying document image as a .jpg, .png, or .pdf (File must be smaller than 4MB).

Click Add Beneficial Owner for the next entry.

- Submit the BOIR

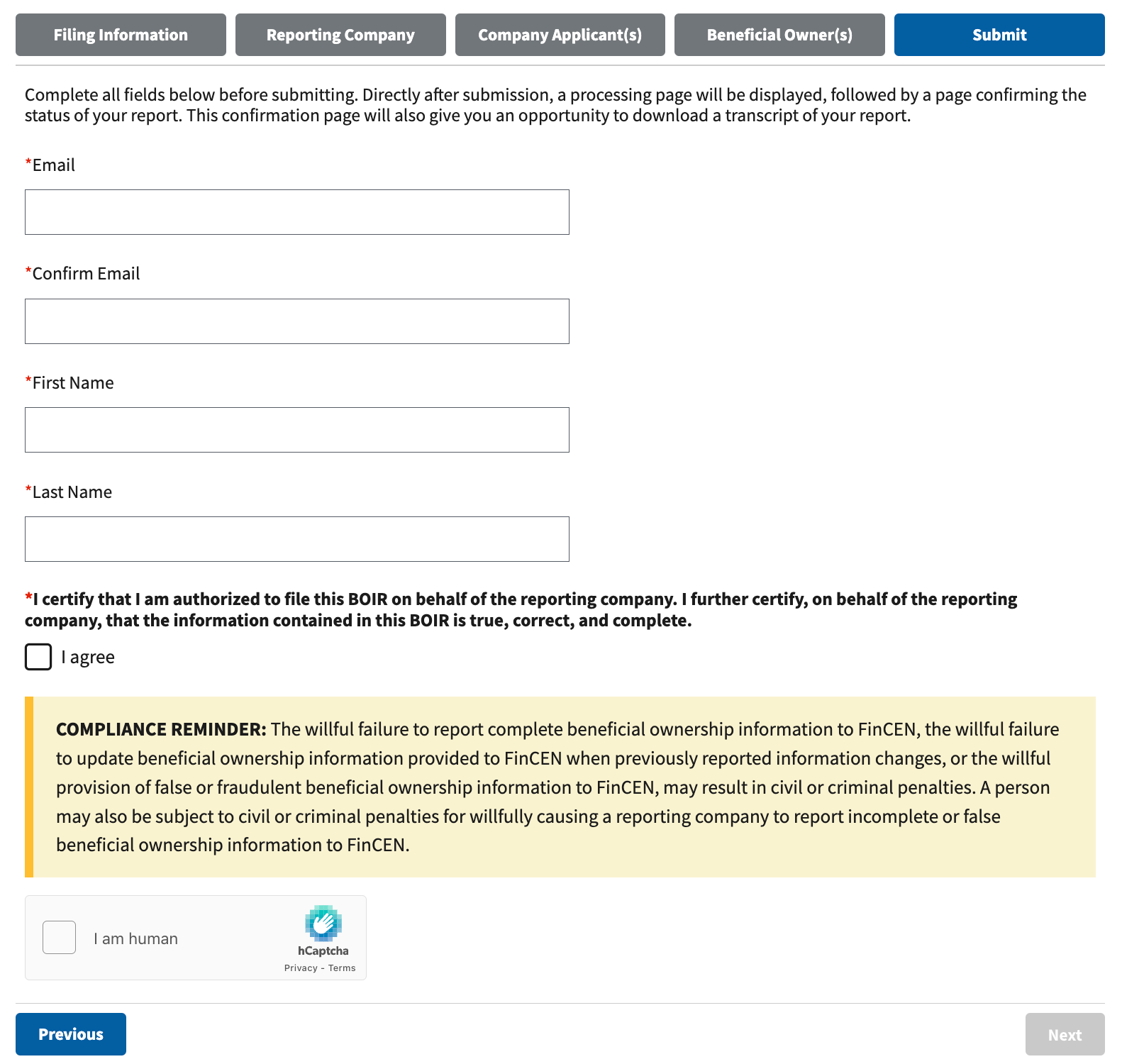

- Enter the authorized submitter's Email, First Name, Last Name

- Check I agree to certify that you are authorized to file this BOIR and that the information contained in the BOIR is true, correct, and complete.

- Check I am human captcha.

- Download a transcript of the BOI Report.

Conclusion

Filing a BOI Report for your HOA may seem like a complex task, but with the right preparation, it can be handled efficiently. Gathering the required information, using our preparation worksheet, and following the steps outlined in this guide can ensure that your HOA complies with the Corporate Transparency Act (CTA).

Ready to get started? Download the free worksheet and start preparing today to avoid unnecessary penalties and ensure a smooth filing process.

Footnotes & References

- Community Associations Institute. October 11, 2024 Corporate Transparency Act Update: Key Hearing Held in Lawsuit.

- Wolters Kluwer. September 30, 2024. Federal District Court in Oregon denies motion for preliminary injunction in Corporate Transparency Act lawsuit.

- Gibson Dunn. March 18, 2024. The Corporate Transparency Act Declared Unconstitutional: What It Means for You.

- Wolters Kluwer. June 4, 2024.Do I need a FinCEN ID?.

- FDIC. Section 7 - Compliance - Pooled Investment Vehicles.

- Community Associations Institute. October 24, 2024 Lawsuit FAQ Fail.

- Winson & Strawn LLP. Federal Judge in Texas Blocks Enforcement of the Corporate Transparenty Act Nationwide and FinCEN STates That It Will Not Require Compliance with the CTA -- For Now

- Financial Crimes Enforcement Network. Beneficial Ownership Information. Alert: Ongoing Litigation – Texas Top Cop Shop, Inc., et al. v. Garland, et al., No. 4:24-cv-00478 (E.D. Tex.) & Voluntary Submissions [Updated January 2, 2025]

- U.S. Department of the Treasury. Press Releases. March 2, 2025. Treasury Department Announces Suspension of Enforcement of Corporate Transparency Act Against U.S. Citizens and Domestic Reporting Companies.

Disclaimer: The information provided in this article is intended for general informational purposes only. It does not constitute legal, financial, or professional advice, nor is it a substitute for consulting with qualified professionals. While we strive to provide accurate and up-to-date information, we make no guarantees regarding the applicability or accuracy of any information provided. Users are encouraged to consult with a qualified attorney, financial advisor, or legal professional for advice tailored to their specific situation. reTHINK HOA is not responsible for any actions taken based on the information provided in this article.

BOI Report Preparation Worksheet

Get organized for your BOI report filing with our BOI Report Preparation Worksheet. This worksheet will help ensure you have all the necessary information ready before you begin the filing process.

Sign in or Subscribe to download the worksheet below! If you have any questions or need further assistance, please comment, and we'll be happy to help.

This content is only available to subscribers

Subscribe now and have access to all our stories, enjoy exclusive content and stay up to date with constant updates.

Sign up nowAlready have an account? Sign in