In the challenging landscape of homeowners associations (HOAs), efficient management is often a delicate balancing act. This case study tells the story of the Normal Heights HOA. This small but committed community transformed its financial health and resident engagement through the power of self-management.

- Mismanagement can lead to significant financial strain on HOAs, manifesting in unclear or unnecessary transactions, unexpected fees, and recurring late or missed payments.

- Continuous efforts towards proactive management and improvement, whether by an external management company or self-management by the board, are essential to maintain financial stability and improve the HOA for all residents.

- The transition to self-management requires a strong commitment from the board and effective engagement and education of community members.

- Self-management is within reach for many small HOAs, and the case of Normal Heights HOA inspires those considering this path.

Profile of Normal Heights HOA

Tucked away in a tranquil corner of the city, the Normal Heights HOA is a vibrant, close-knit community of five units. From 2012, it had entrusted an external management company with its financial and administrative responsibilities. With the departure of the original board members who had signed the contract, the existing board grappled with limited financial oversight—a predicament exacerbated by the management company's exclusive control over the HOA's bank account and the inaccessible documents detailing the original contract.

The Cost of Mismanagement: A Deep-Dive Analysis

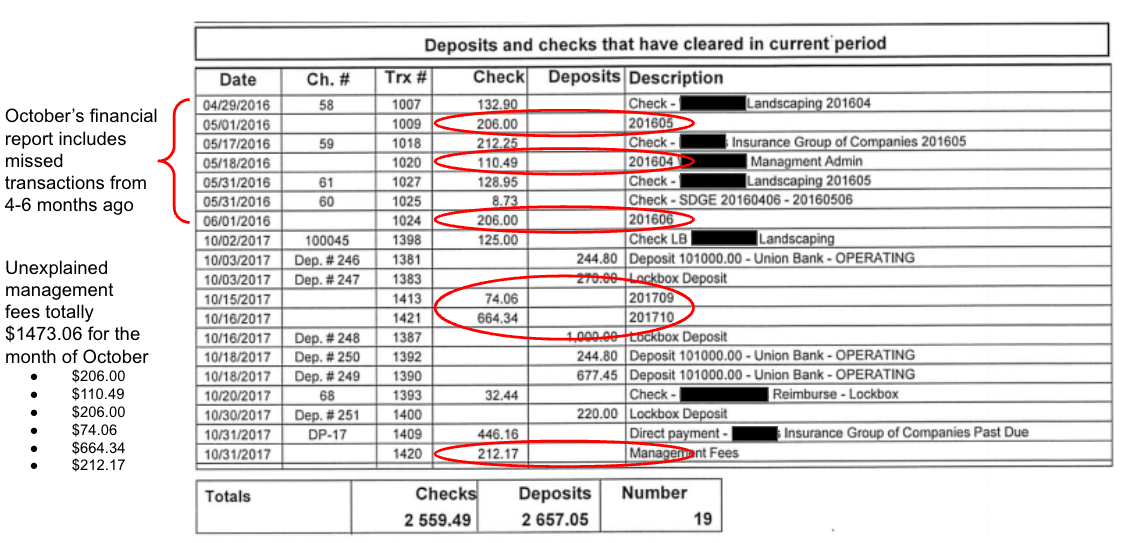

Mismanagement significantly strained the Normal Heights HOA. Owing to inaccurate financial statements, vague transaction descriptions, and undisclosed late payments, the board remained oblivious to the grim financial landscape until much later. Table 1 provides a snapshot of a typical month's financial transactions, as provided by the management company. This specific report pertains to the month of October.

Variable, Unexpected, and Unexplained Management Costs

As depicted in Table 1, the HOA was charged for services and fees rendered in April, May, and June, even though these transactions were reported as part of October's financial statements. These belated transactions were not listed in the balance sheets' accounts payable for those months. Further compounding the confusion, unexplained management fees totaling $1473.06 were recorded with vague descriptions such as "2017xx" and "management fees."

Regular Special Assessments

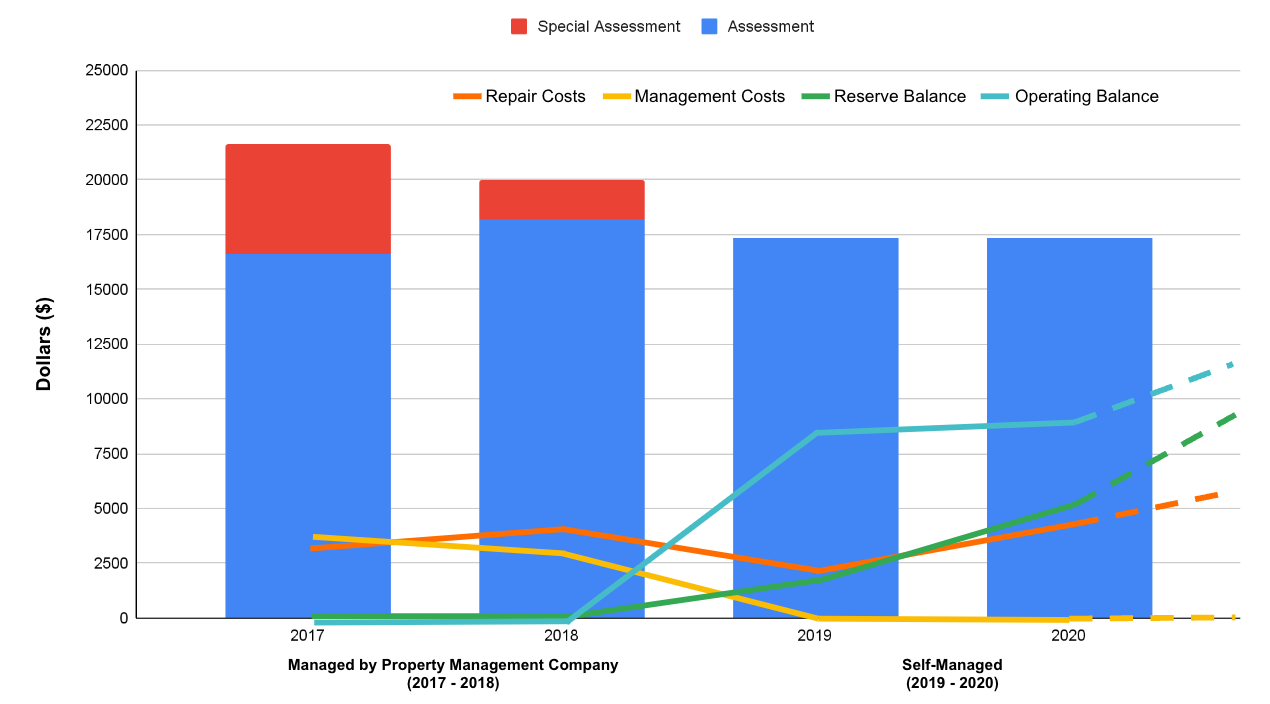

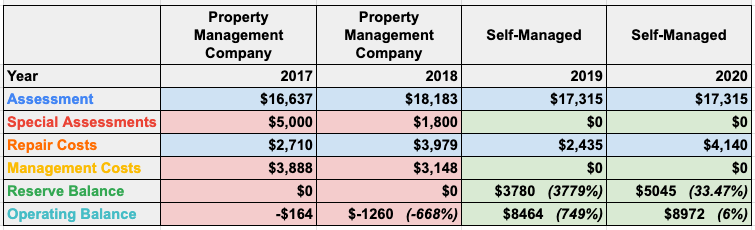

Special assessments, typically implemented as an exception to cover extraordinary expenses, became a recurring burden, causing financial stress for homeowners. Chart 1 and Table 2 illustrate the relentless special assessments. Note that the reserve savings amount for 2017 and 2018 were reported as $0.00. However, the balance sheet inaccurately reflected a reserve balance of $3756.30.

Late and Missed Payments

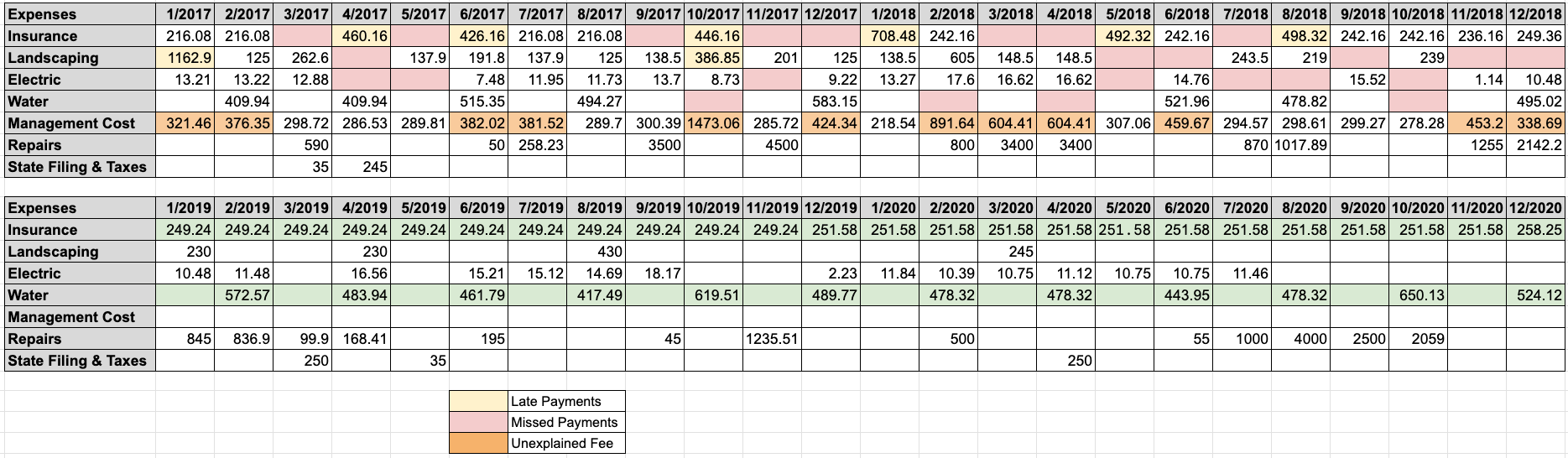

Under the supervision of the management company, the reported reserve balance turned out to be a facade, and late or missed payments emerged as a recurring issue. In the two year period, 33 of 97 payments were late or missed. Table 3 provides a monthly breakdown of late payments (highlighted in yellow), missed payments (in red), and unexplained, unusually high management fees (in orange).

Case Study

(Click to Enlarge)

The Path to Self-Management

After several failed attempts to get satisfactory explanations from the management company regarding the charges, discrepancies, and missed payments and the associated late fees, the board made a pivotal decision—to transition to self-management. This bold decision marked the beginning of a six-month-long transition phase to terminate the contract with the management firm. This period was characterized by numerous hurdles but also significant breakthroughs. The journey to successful self-management necessitated thorough research and a concerted effort by the board. Look out for a future article detailing the complete process of this exhilarating transformation.

Impact of Self-Management

The decision to self-manage ushered in a period of remarkable transformation. The roles of the board members were redefined, and homeowners became more proactive. The financial improvements were significant, and several key benefits were observed:

- Increased Engagement: With the transition to self-management, homeowners became more engaged, which led to the on-time payment of dues, thereby increasing the overall dues collected.

- Elimination of Special Assessments: Regular special assessments, a major source of dissatisfaction, were eliminated, relieving homeowners and stabilizing the financial outlook.

- Improved Financial Health: The reserves experienced a substantial year-over-year increase (3779% increase in the first year and 33.47% increase in the second year), indicative of improved financial health under self-management.

- Management Cost Savings: Savings from eliminating management costs were redirected towards necessary repairs and bolstering reserves.

- Net Worth Growth: The association's net worth demonstrated consistent year-over-year growth, further evidencing the financial stability attained through self-management.

In addition, the shift to self-management led the board to make more strategic and cost-effective decisions. One significant decision was the change from a weekly landscaping contract to a quarterly schedule. Given the limited common areas maintained by the HOA—just three palm trees near the mailboxes—this change allowed the HOA to cut back on unnecessary expenses and build up reserves more quickly.

Lessons from Normal Heights HOA

The transformative journey of the Normal Heights HOA offers several invaluable lessons for other small HOAs considering self-management:

- Strong Board Commitment: The success of Normal Heights' transition to self-management hinged on a strong board commitment.

- Effective Member Education and Engagement: The case of Normal Heights underscores the transformative power of a well-informed and involved community. It emphasizes the importance of consistent communication with members, ensuring everyone is informed and invested in the common goal.

- Financial Transparency and Oversight: The association's journey underscored the immense value of self-reliance and informed decision-making. The board took control of their HOA's financial future, turning challenges into opportunities for learning and growth.

- Optimal Use of Resources and Tools: Leveraging the right resources was another critical aspect of the journey. By doing so, the board navigated the complex transition phase and effectively managed the community's affairs.

- Proactive Management and Continuous Improvement: The association's transformation from financial instability to a model of financial stability was not a one-time effort but a testament to the ongoing commitment to improving the HOA for all residents.

Their journey illustrates that with commitment, thorough planning, homeowner engagement, and the right resources, every HOAs can effectively manage their affairs and future-proof their communities.

Final Thoughts

Normal Heights HOA's story stands as a beacon for HOAs seeking the power and potential of self-management. With the right strategy, HOAs can determine their destiny, ensuring stability and prosperity for their communities.

Ready to chart a similar journey for your HOA? At reTHINK HOA, we're poised to guide you toward effective self-management, just as we did for Normal Heights. Contact reTHINK HOA and shape a brighter tomorrow for your community.